Latest

Top things to look out for in ecommerce in H2

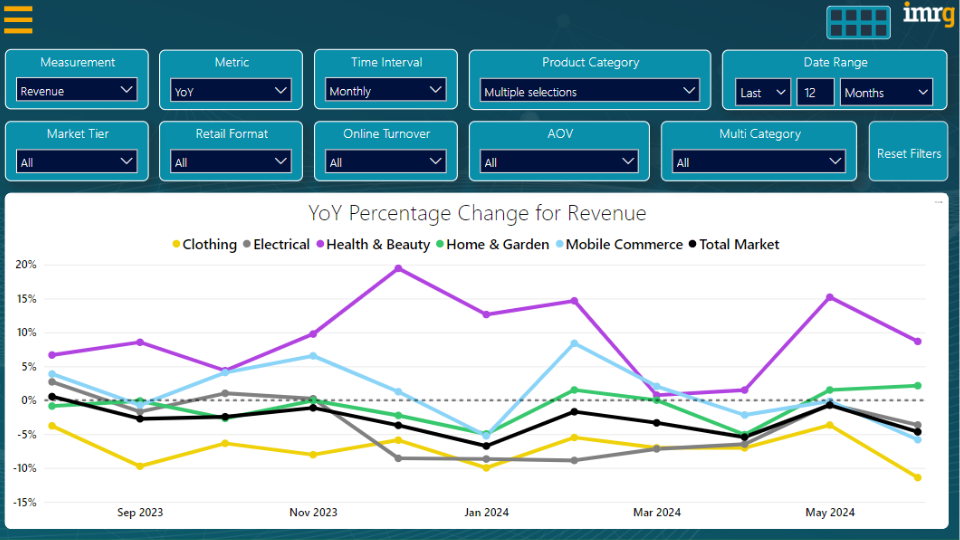

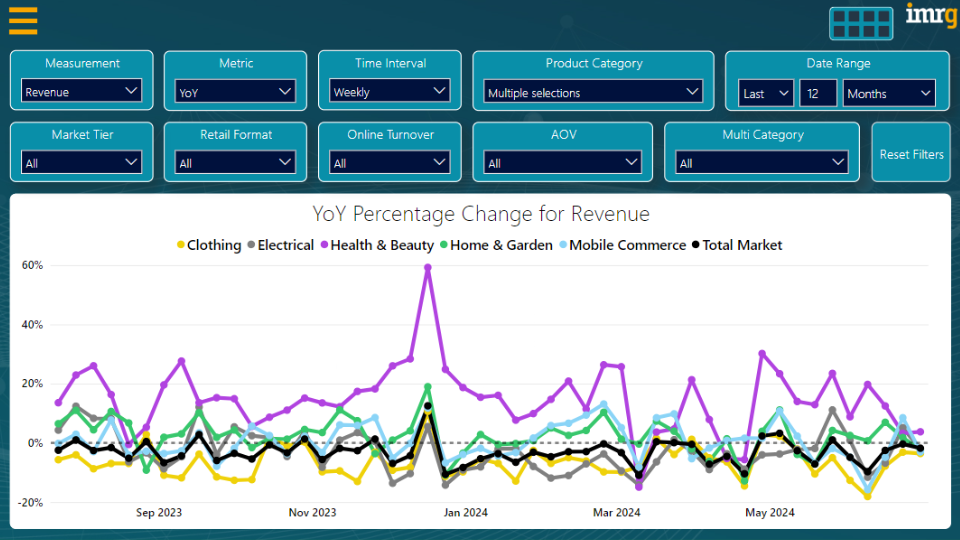

It’s been a challenging year in eCommerce of that there can be no doubt. Despite Google’s insistence of ‘query growth’, both online traffic and revenues have slumped in the last year, with Health and Beauty the only category to buck the trend and beat last year according to IMRG data. Clothing and electrical categories have had particularly bad years with terrible weather and cost of living challenges combining to depress customer appetite and sales.

Good News is on the Horizon

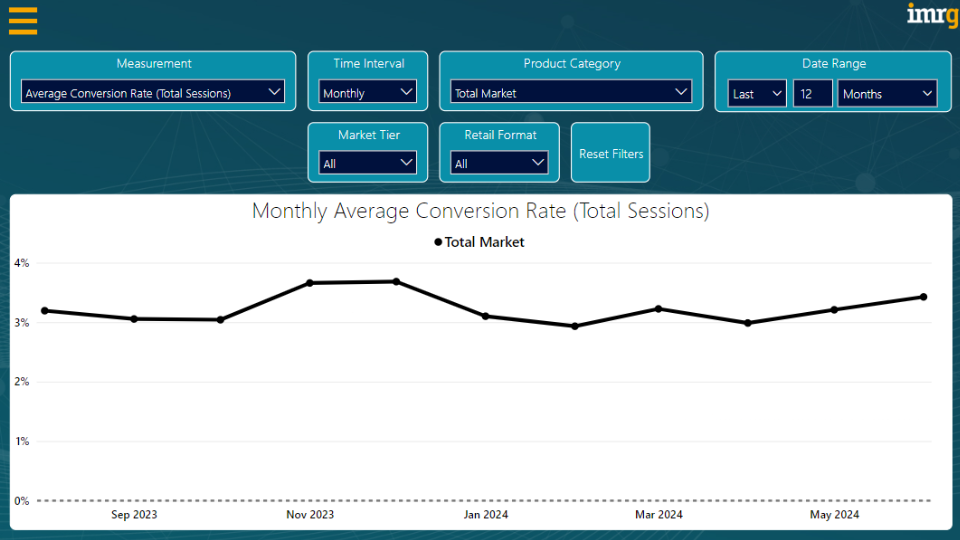

I am pleased to say there is some good news on the horizon. The Euros, Olympics and UK election have combined to give a welcome boost to hospitality and retail sectors (+£3B) with average conversion rates reaching peak levels at near 3.5% and clothing and electricals finally having some better weeks in regards to revenue. The effect can be seen across all categories and interestingly, in recent weeks, there isn’t one laggard category pulling the total eCom market down.

Spend the Lower Marketing Budget in the Right Places

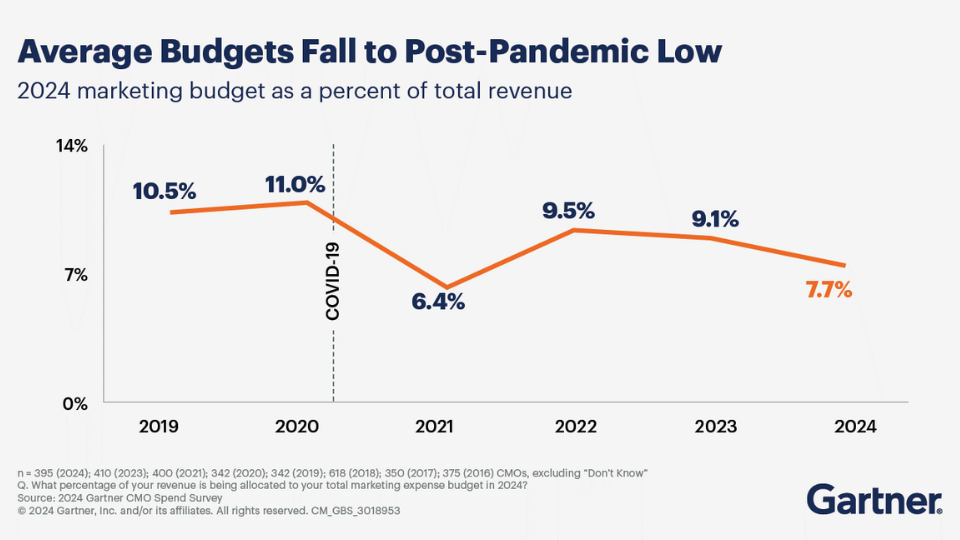

The issues of the last year are partly driven by macro-economic factors (wars, inflation, interest rates, weather etc) but they are also a factor of ‘damage limitation’ business planning. The first half of 2024 is certainly influenced by this. Partly because of underperformance the previous year, but also brands cost cutting into their financial year end (predominantly April) and then having less budget and revenue to work with starting their new financial year, coming into Summer. The Gartner CMO survey clearly indicates that CMOs are being asked ‘to do more with less’ with marketing budgets as a % of brand revenues falling by 15% from 9.1% to 7.7%. Paid media investment increased – especially at the top and the bottom of the funnel, As has ‘digital’ spend up from 54% to 57% of budgets. But declines in operational spend such as mar tech have funded this growth. Give with one hand and take with the other.

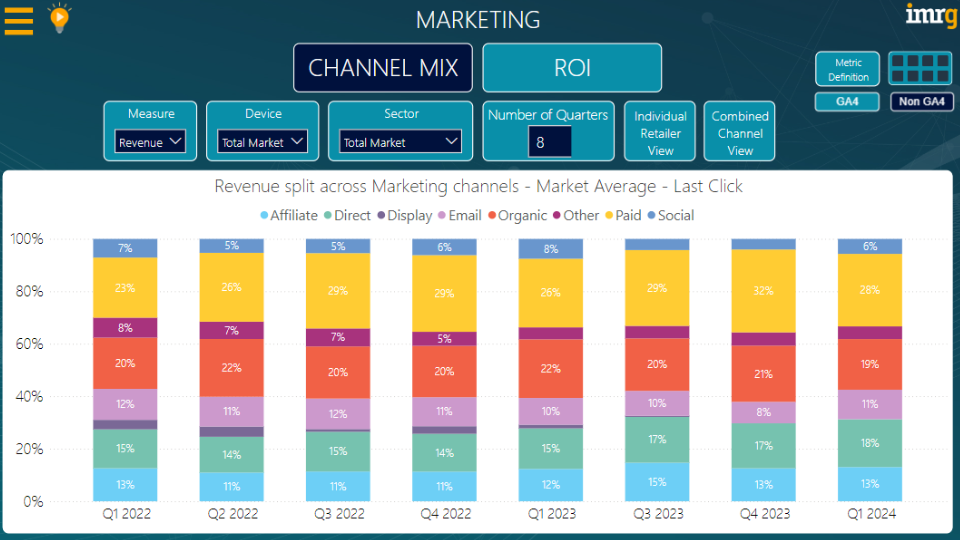

Invest in a Broad Channel Mix

The changes in budgets and behaviours can also be seen at a channel level and we expect this to continue. Compared to Q1 2022 we’re seeing larger proportions of budgets in paid advertising (28% vs 23% last click) as a result of CPC increases (c.22% by our calculations), as well as the comfort from CFOs and CMOs alike in sell through and ROI. What was maybe less expected is the increase in ‘direct’ as a channel which has grown its share from 15% to 18%. This is a combination of protecting brand advertising, as the CMO survey above highlights, but also a weakening of the channels that operate in the mid funnel. The most obvious example of this is the ‘display’ channel which has all but disappeared, with clicks gobbled up by Google’s Pmax platform and new Demand Gen campaign format as well as platforms such as Meta and Tik Tok.

I return to the fact it has been a hard year. “Do more with less” has been the mantra but performance of late has improved, consumer confidence is better than it has been for many years and maybe just maybe there is some extra budget squirrelled away for H2 so retailers can run right through some soft Year on Year targets in peak. As is the way, it’s unlikely retailers will sell more and drive growth by cutting budgets so my advice is; plan well, use the right technology to maximise ROI (such as Productcaster!), work across a broad channel mix and keep the focus on efficiency, test and learn and clear measurement frameworks.

Written by Martin Corcoran

References:

IMRG

CMO Gartner Report

Ready to switch? Let’s get started.

Book a Demo